While owner-occupiers are seeking downsizing alternatives in coastal areas, investors are returning to the Gold Coast in the wake of historically low rental vacancy rates.

Ashwin Property director Tony Ashwin revealed increased yields, rising property prices and bullish forecasts have encouraged a return of investors to the Gold Coast market.

Mr Ashwin suggested a notable cohort of investors have started to purchase town houses in projects on the northern Gold Coast, encouraged by price growth, increased yields and improving infrastructure. He is currently marketing a $650 million waterfront development project in Helensvale.

“We are certainly seeing an uptick in investors inquiring, although the market is still predominantly owner-occupier,” Mr Ashwin said.

“There is a lot less stock out in the market currently and investors are certainly being encouraged into master planned communities which have great internal and surrounding infrastructure.

“The supply of four-bedroom homes has become particularly sparse on the Gold Coast, positioning this product as one of the most sought-after commodities on the property market.”

Mr Ashwin said the various local government infrastructure investments currently underway had encouraged investors back into the northern Gold Coast. This includes the Coomera Connector, which is set to reduce travel times around the Gold Coast region.

“People working in Surfers Paradise or Broadbeach may not have considered living or renting in northern Gold Coast locations like Hope Island and Helensvale because of the travel times, but now we’re talking 15-20 minutes once the Coomera Connector is complete,” he said.

The investor boom in rental markets comes as many owner-occupiers around the country are looking to downsize in coastal areas, such as the Gold Coast.

Downsizing.com.au CEO Amanda Graham suggested more over-50s are seeking a new sea change lifestyle with easy access to the big smoke.

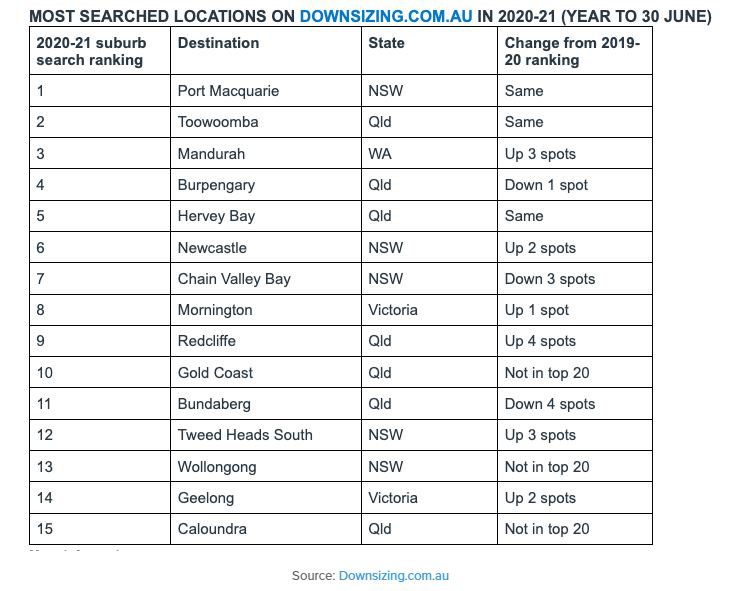

An analysis of consumer search activity during the financial year 2020-21 has revealed a clear shift towards waterside regional or outer urban areas which frame large cities.

As well as the Gold Coast, other areas that have seen more consumers looking for downsized or retirement living include Mandurah in Western Australia, Newcastle and Wollongong in New South Wales, Redcliffe and Caloundra in Queensland, and the Mornington Peninsula and Greater Geelong in Victoria.

Ms Graham said the ongoing pandemic and related residential housing boom has sparked more over-50s to consider downsizing to a lifestyle-rich area.

“This generation has already accumulated considerable equity in their home after decades of paying off a mortgage,” Ms Graham said.

“Their home has been their biggest investment over their lifetime and is now the key to their financial freedom.

“For many of these downsizers, moving to a regional area on the outskirts of a major city is very appealing. It gives them the best of both worlds – a new coastal lifestyle away from the hustle and bustle along with the ability to easily travel back into the city to see family and friends, or have them visit.

“In saying this, we are still also seeing very strong growth in search activity for capital city areas, which remain popular with downsizers seeking a vibrant urban lifestyle, along with a newer, more modern home with less maintenance.”

Article Source: eliteagent.com